The COVID-19 pandemic has changed customer expectations in the banking industry. Most banks have started their own digital or mobile solutions. Yet, these actions may be insufficient for users. They expect personalized service and a seamless experience related to daily banking operations. Hence, banks need to take extra steps towards better and instant customer service.

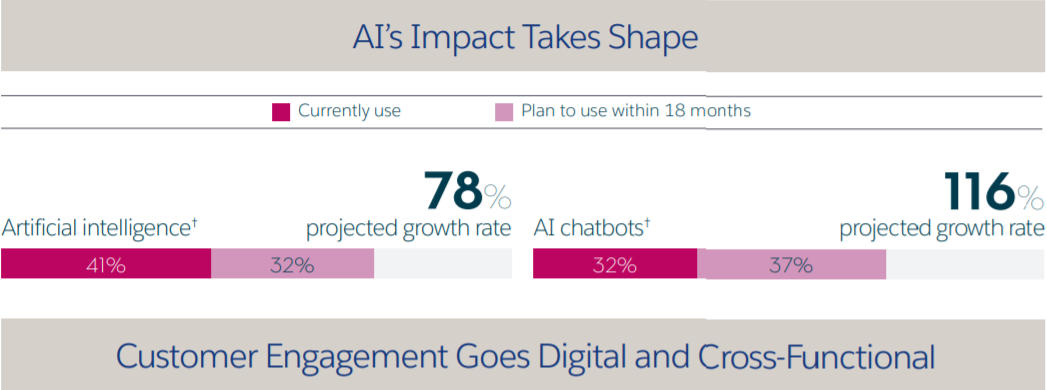

A Salesforce report reveals that 32% of companies in the financial sector already employ AI-based chatbots, and 37% of companies are working towards implementing chatbots within 18 months. AI chatbots are one of the difference-making technologies for banks. They connect automation with a human-like experience to enhance services and make daily actions more convenient and hassle-free. You can build a chatbot for banking and implement it as a part of a mobile app or website.

In this article, you will learn about the use cases and the advantages of chatbots in banking. This article is for those considering building a chatbot for their banking business.

Top Use Cases for AI Chatbots in Banking

If you are thinking about creating a chatbot in Python for your bank, here are the examples of use cases. By developing a custom chatbot software solution, you can broaden their functionality.

Landing new customers

Chatbots are unparalleled for customer acquisition. They initiate communication, ask engaging questions and provide prompt replies. Hence, banks use them to broaden their customer base and generate new leads.

Lead qualification

Not only can chatbots get in touch with leads, but they can also ask relevant questions to qualify them. This will help the bank make the most suitable offer for every client.

Collecting feedback

Feedback forms and surveys are no longer effective. A chatbot increases customer engagement. Chatbots can understand and generate natural language. Natural language processing is a combination of artificial intelligence and machine learning. It allows chatbots to:

- recognize language;

- translate between relevant natural languages and programming languages;

- recognize spelling mistakes, accents, and slang;

- detect spam, noise, or other indicators of unproductive or meaningless talk;

- extract data from the user’s text or voice information;

- analyze and classify information received from a user; and

- generate responses.

Yet, this technology can be too complex to develop. There are alternatives with narrower functionality like rule-based chatbots or choice-based chatbots.

FAQ automation

When it comes to money matters, customers ask tons of questions about their accounts and different banking services. Chatbots can handle these repeated flows of questions. They automate common queries and allow support specialists to focus on enhancing customer experiences.

Notifications and reminders

Many banks use chatbots to notify about upcoming operations, deadlines, and limited offers. This keeps the customers updated about products and services.

Personalized marketing strategies

Chatbots can analyze conversations with customers and customize the messages. Their lead generation and qualification capabilities allow them to offer the most relevant suggestions.

How do customers benefit from banking chatbots?

Instant communication

This is especially beneficial in the case of voice chatbots. The chatbot is much faster for banks than waiting until you reach a live manager via a phone call. Live communication can also cause stress for customer service specialists because they have to work with mostly unsatisfied clients. Moreover, they have to do it daily and adhere to protocols, no matter how dumb, furious, or irritated the customer is. Properly designed chatbots are always polite and to the point. Their performance does not depend on mood, and they react at once and don’t forget things.

24/7 support

Chatbots offer round-the-clock support so that existing and new customers can solve their banking issues at any time, even outside of work hours and weekends. Such an accessible service skyrockets customer satisfaction.

Automated queries

A banking bot is a great tool for automating common customer queries related to products, services, offers, etc. Banks can take advantage of them to provide quick responses and improved customer experience. This increases the productivity of banking agents by giving them free time and allowing them to focus on more complicated issues rather than dealing with basic customer queries.

Personalized customer experience

Chatbots in banking can access the full information on the current client even before beginning the communication process. They identify and verify the client automatically based on details like a phone number, login/password, authorization token, or other elements of secure and reliable identification. This way, they may greet a client by name, communicate in their preferred language, make customized suggestions and promotions, etc.

How do banks benefit from AI-based bots?

Saving costs

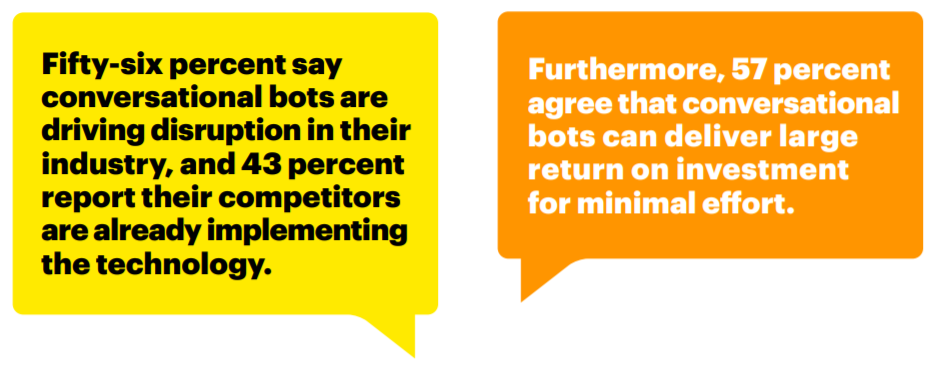

Accenture research reveals that 57% of companies agree that chatbots can result in huge ROI with minimal effort. Developing a custom chatbot is faster and more cost-effective than unscaling your customer service team. Chatbots can handle more customers and are available 24/7.

Fraud reduction

Online fraud is one of the biggest concerns of bank customers and credit card users. Banks keep lots of sensitive data, so they can’t always count on human-touch support. The ability to make the loop of PII exchange fully automated is one of the most significant benefits of banking chatbots. Chatbots can also be designed to follow the protocols of data privacy and protection.

Chatbots can notify customers about suspicious activities from their accounts and become instant assistants in case the account was hacked. They also can set the right priorities for requests for getting in touch with a live agent.

What is The Future of Chatbots in Banking? Statistics and Forecasts

The share of banks that use chatbots is constantly increasing. This tendency has no signs of stopping as the use of mobile banking apps is also on the rise. Research by Juniper reveals that 90% of bank-related interactions will be automated by 2022 with the use of chatbots.

Leverage the Benefits of Chatbots for Banks

Chatbots have become a must-have in the banking industry, where customer experience plays a decisive role. Banks should understand the ever-changing requirements of customers and plan to build chatbots to address them effectively.

The use of banking bot technologies helps provide instant and personalized support. This exceeds the customer expectations and gives your company even greater value.